The borrower also gets the option to choose the repayment terms that best suit their needs and financial situation. When it comes to repaying the loan, you can do it by setting up an automatic deduction or money check. This makes it easy to stay on top of your repayments and ensures you don’t miss any payments.

Flex Loans for Bad Credit

Online flex loans are often available to borrowers with bad credit. Online flex loans for bad credit are more lenient regarding credit requirements. To qualify for a flex loan with bad credit, we consider other factors, such as your income, employment history, and overall financial stability. As we understand that a credit score doesn’t always reflect a borrower’s ability to repay a loan. By considering these other factors, we provide more opportunities for borrowers with bad credit to access the funds they need.

Difference between Flex Loans Near Me and Online Flex Loans

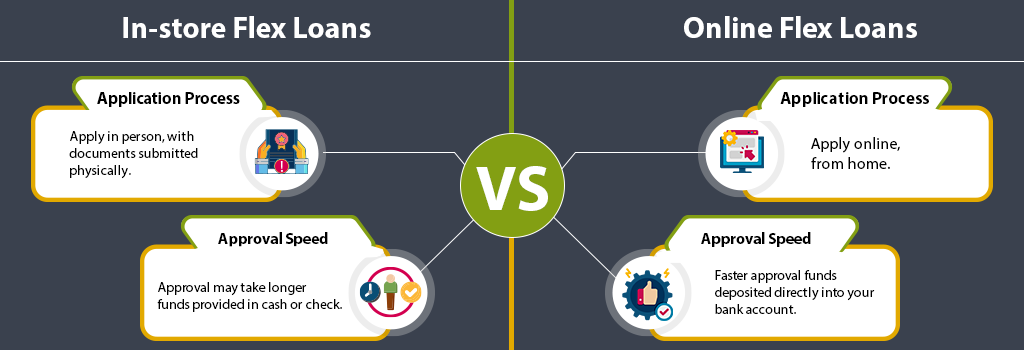

While both in-store flex loans and online flex loans offer the same flexible borrowing options, there are some critical differences between the two. Flex loans near me are typically obtained by visiting a physical branch or store location. The borrower will need to provide all the necessary documentation in person and may have to wait for the approval process to be completed. Once approved, the borrower will receive the funds in person, cash or check.

On the other hand, online flex loans offer a more convenient and streamlined borrowing experience. The application process can be completed online from the comfort of your home. This eliminates the need to visit a physical branch or store location. The approval process is usually quicker, with funds being deposited directly into your bank account. This gives borrowers the ability to access the money without needing any physical interaction.

Online flex loans also offer more flexibility when it comes to repayment options. With in-store flex loans, the borrower may need to make payments in person or through a physical check. Online flex loans, on the other hand, often offer automatic deductions from your bank account or online payment portals. This makes it easier to stay on top of your repayments and ensures you don’t miss any payments.

Online Flex Loan Eligibility Requirements

To be eligible for an online flex loan, you typically need to meet certain requirements. These requirements generally include:

- Being at least 18 years old

- Having a valid checking bank account

- Having a steady source of income

- Valid proof of residency

- Valid contact information

- Proof of identity such as SSN.

Need money with Bad Credit? Get them with PaydayLoanTeller

If you have bad credit and need money urgently, PaydayLoanTeller is here to help. We understand that life can throw unexpected financial challenges your way, and we believe everyone deserves a fair chance to access the funds they need. That’s why we offer flex loans for bad credit, providing a lifeline to those who may have been turned away by traditional lenders in the past.

At PaydayLoanTeller, we focus on your ability to repay the loan rather than your credit score. As long as you have a steady source of income, we can provide you with a flex loan that suits your needs. Our application process is quick and easy, and we strive to provide instant loan approval.

We understand that financial emergencies can’t wait, so we offer 24/7 online access to our services. Whether it’s the middle of the night or a weekend, you can apply for a flex loan with us anytime. Our customer support team is also available round the clock to assist you with any questions or concerns you may have.