Get Instantly Approved

Because our approval process is QUICK!

Get Funded

Yes, you read that RIGHT!

Internet Payday Loans – What are they?

Are you in need of a loan but need help figuring out where to turn? What if we told you that you don’t need to go anywhere to get a loan? Well, you’ll obviously want to know more about it before proceeding. We’ll introduce you to Internet payday loans to make things easier for you.

Internet payday loans are a type of short-term borrowing that individuals can access online. They are designed to provide quick financial relief to individuals facing unexpected expenses or emergencies before their next paycheck arrives. The application process for Internet payday loans is usually straightforward, involving an online form and minimal documentation. Upon approval, funds are often deposited directly into the borrower’s bank account.

Now that you’ve understood what Internet payday loans are let’s learn more about them so you can easily apply for one and get financial relief in times of need.

Why choose Internet Loans over In-Store Loans?

When you need some extra cash between your paychecks, you may want to save time getting a loan when you can do it swiftly while sitting at your home, at your convenience.

Choosing Internet loans over in-store loans will save you time and effort and get hands-on money without any hassles.

First, internet loans provide greater convenience as they can be applied for and processed online, eliminating the need to visit a physical location. This will benefit those with limited time or mobility constraints or who prefer the privacy of online transactions.

Additionally, internet loans have quicker approval and disbursement times than in-store loans, allowing borrowers to access funds more rapidly.

What benefits do Bad Credit Borrowers get?

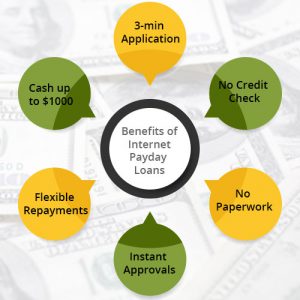

The most important advantage of getting internet loans for bad credit is that they are accessible to all borrowers, and no credit check is required to qualify for the loan. Still, let’s have a look at all the benefits a bad credit borrower will get when they choose us:

- Firstly, the application process gets completed in just 3 minutes

- No paperwork, no store visit, no faxing is required

- A credit check is not required

- Instant approval given the information provided by you is correct

- Same-day cash with competitive interest rates

- Option to pay back in easy installments

- Direct deposit of up to $1,000

- Automatic repayment from the bank account

- Free from hidden fees

Check your eligibility before applying for Internet Payday Loans

As a direct lender of Internet loans for bad credit, our policies are obvious and simple; we do not conduct credit checks, but there are a few essential eligibility criteria you need to meet before you can get a loan from us.

To apply from PaydayLoanTeller,

- Age requirement is 18 years or older

- You must provide us with an active checking account

- You should be able to give us pay stubs/income statements from the last three months

- You should be a permanent resident of the US/a legal citizen

- It is important that you have a valid phone number and email address.

Safe Internet Installment Loans from PaydayLoanTeller

When you choose to apply for a loan on the internet, you may question the legitimacy of the online loan lender, but when you choose us, you can be sure of the loan’s safety. We have a reputation for lending money without compromising the confidentiality of borrowers’ information. Our loan procedure is straightforward, and we enlist our terms and conditions clearly so no one gets confused at the last minute.

Moreover, internet loans can be accessed online, making things easier for borrowers like you, so why wait when you can get Internet installment loans now.