Get Instantly Approved

Because our approval process is QUICK!

Get Funded in a Day

Yes, you read that RIGHT!

Payday Loans in Tennessee

Are you in need of quick cash in Tennessee but worried about your credit score? Well, everyone finds themselves in a cash crisis at least once in their life, and sometimes waiting for your next paycheck just isn’t an option. We have a solution for you: Tennessee payday loans! We offer no credit check loans that can help you bridge the gap between paydays.

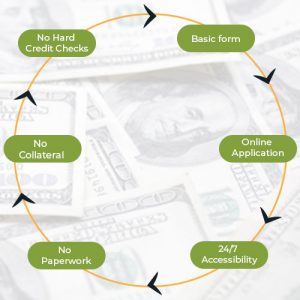

With PaydayLoanTeller’s payday loans in Tennessee, the application process is simple and easy. No lengthy paperwork or credit checks are required, as we believe that everyone deserves access to the funds they need, regardless of their credit history, so we are committed to helping you get the money you need with no hassle.

Understanding Payday Loans

Tennessee payday loans offer a convenient solution for individuals who find themselves in need of quick cash. These short-term loans are designed to fill the gap between paydays and provide immediate financial relief. Tennessee payday loans can help you get the funds you need without the hassle of a traditional bank loan.

Payday loans operate in a simple way: you borrow a small amount of money, typically ranging from $100 to $1,000, and repay it with your next paycheck. The application process is quick, and no credit check is required. This means that even if you have a less-than-perfect credit score, you can still qualify for a payday loan in Tennessee.

Why get Online Payday Loans in TN?

Online payday loans in Tennessee offer numerous advantages over traditional loans. One of their main benefits is the speed and convenience they offer. With online payday loans in TN, you can complete the entire application process from the comfort of your home. You don’t need to visit a physical location or wait in line. Simply fill out the online application form online, provide the necessary documentation, and wait for approval.

Online payday loans have a quick approval time. Unlike traditional loans that may take weeks to process, online payday loans in TN can be approved in as little as the same day of application. This means that you can get the funds you need when you need them most without having to wait for days.

Our online payday loans offer flexibility in terms of repayment. Even though this type of loan is typically due on your next paycheck, you may be able to get extended repayment options if you feel you cannot pay it back on time. Just let us know before the due date. This allows you to repay the loan over a longer period of time, making it more manageable for your budget.

I have bad credit. Can I get Payday Loans in Tennessee?

Payday loans online in TN are available to individuals with bad credit. Traditional lenders often rely heavily on credit scores when determining loan eligibility, making it difficult for those with bad credit to secure a loan. However, payday lenders like us understand that a credit score does not necessarily reflect an individual’s ability to repay a loan.

As a direct lender of payday loans in TN, we focus more on your income and employment status rather than your credit history. As long as you have a steady source of income and can demonstrate your ability to repay the loan, you can qualify for a loan.

Requirements for Payday Loan in Tennessee

While we don’t require a credit check for payday loans in Tennessee, there are still a few criteria that you must meet in order to qualify. These requirements include:

- Age: Applying for a payday loan in Tennessee requires you to be 18 years of age or older.

- Proof of income: You must have a steady source of income and provide pay stubs or bank statements as proof of income.

- Bank account: You will need an active checking bank account to receive the loan funds and make repayments.

- Identification: You will be required to provide a valid form of identification, such as an SSN.

- Contact information: Your phone number and email address should be active and valid.

How can I utilize Online Payday Loans in TN?

Online payday loans in Tennessee can be utilized for a variety of purposes. Whether you need to cover unexpected medical expenses, improve your home, repair your car, pay an overdue utility bill, or just go through the next paycheck. Payday loans provide the flexibility to meet your immediate financial needs right when you ask for them.

Genuine Direct Lender For Tennessee Payday Loans

When it comes to payday loans in Tennessee, it’s crucial to choose a genuine direct lender that you can trust. PaydayLoanTeller is a reputable online lender that specializes in providing payday loans to Tennessee residents. With a quick and easy application process, no credit checks, no paperwork, no faxing, and flexible repayment options, PaydayLoanTeller is dedicated to helping individuals get the funds they need without the stress.

Don’t let a bad credit score hold you back from accessing the cash you need. Apply for a no-credit check loan with PaydayLoanTeller today and experience the convenience and flexibility of online payday loans in Tennessee.